As we approach the end of 2020, the April 2021 IR35 start date is beginning to loom on the horizon. Are you ready?

To offer some extra guidance the Tax Centre of Excellence (CoE) recently refreshed its IR35 Assessment Guidance for off-payroll working in the public sector. This information is to help members make decisions on the tax status of off-payroll worker. Helpfully, the content has also been checked with HMRC for accuracy.

In this post, we delve into this document and explain why the ideas put forward by HMRC are maybe misplaced. We also draw on some solutions to help you remain on the right side of IR35.

Nominated Workers – The HMRC view

Arguably, this is one of the most authoritative and elaborate pieces of guidance on IR35. This document takes a purist approach in line with how the HMRC would want to see organisations apply IR35 principles. The guidance is particularly harsh on nominated workers. They are people who the client has known from the past and has specifically sought their services for a new piece of work.

Networking is one of the biggest sources of jobs and this pool is a growing pool as departments get familiar with more contractors over time. Naturally, this means the hirer is known to the contractor in advance. However, HMRC has determined that they are mostly inside IR35 because the client has specifically sought their service.

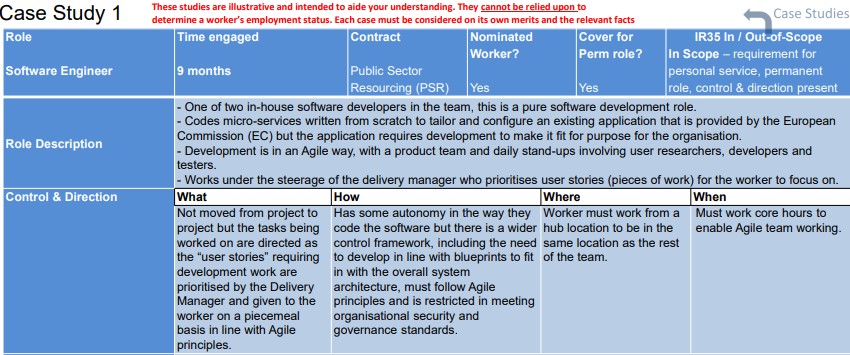

In the guidance document, several case studies are intended to aide our understanding of IR35. Interestingly, out of the five case studies which use a nominated worker as part of their example, four are deemed as being inside IR35. For example, in Case Study 1 (seen below) the scenario is of a Software Engineer who has been engaged for nine months. As HMRC explains:

“There is no expectation that the worker will ever send a substitute as the business area would like personal service. The worker also has established knowledge of the IT system being developed which a substitute would not have, making substitution impractical.”

Thus, this nominated worker is deemed as being inside IR35.

Arguably, this is one of the most authoritative and elaborate pieces of guidance on IR35.

Nominated Workers – Our view

In our view, this theory is probably misplaced at two levels.

- In some cases, a client may like a specific worker and may require that worker be involved. For example, in Case Study 1 the worker had established knowledge of the IT system being developed which a substitute would not have. However, it is arguable that the client will be equally as happy for the worker to: a) provide their services personally, as much as they would be with b) the worker supervising the provision of the services through a substitute.

- A client may interview many candidates to select one worker for an outside IR35 role. Theoretically, once they have made their choice of who they want to contract with, they reach the same point as they do for a nominated worker, i.e. that there is only a specific person that they want to be performing that service. However, the guidance doesn’t suggest that at this point the role turns inside IR35.

How to stay on the right side of IR35

Fortunately, there are some ways in which nominated workers can stay on the right side of IR35 and HMRC.

1) Hire for more than Personal Service

A neat way of contracting a nominated worker is to code supervision into their scope of services. This creates an obligation to either perform services personally or ensure similar outcomes by exercising their substitution clause. Including a right of substitution in your contract will keep you on the right side of IR35. All you have to do is prove that you could substitute, or that you would. At a tax tribunal hearing, Lorraine Kelly’s lawyers successfully argued she was instrumental in choosing substitute presenters. As a result, it was concluded that the relationship was a “contract for services”. Therefore, IR35 did not apply.

“One of the key tests of employment status for tax is substitution – whether the firm would accept a substitute for the contractor if the need arises.” Our Director Amit Kapoor, speaking to People Management.

2) Statement of Work (SoW)

Nominated workers should have stronger defences on other IR35 parameters, i.e. a Statement of Work (SoW). If the contractors are part of a SoW, it’s the “scope of services” (and not the client) which guides their work. As a result, this arrangement falls on the right side of IR35. The whole service may not be conducive to stage / milestone-based payments but it is possible to break the contract value into a 60-40 or so mix of retainer payments and stage-based payments.

3) Insurance-backed engagement

IR35 insurance is another defence mechanism against the potentially crippling costs that can arise from an IR35 enquiry. The Kingsbridge IR35 Protect product protects contractors and others in the supply chain if they are caught by HMRC for the IR35 liability. It covers whoever HMRC deem liable in an IR35 investigation – whether that’s you, your end client, or your recruiter – offering peace of mind throughout the supply chain.

Final Thoughts

We believe that this guidance is harsh on nominated workers as they have been determined by HMRC as mainly inside IR35. In this post, we have identified why we think this doesn’t close all doors to outside IR35 engagement.